Introduction

Three weeks into my first intermediate accounting course, I was convinced I'd picked the wrong major. Every lecture felt like learning a foreign language, and the looming question of "CPA or CMA?" only added to the panic. Frankly, most students I advise today feel the exact same way—paralyzed by the fear of choosing the "wrong" path and wasting 400+ hours of study time.

If you're drowning in acronyms and unsolicited advice from Reddit, take a deep breath. You aren't alone. A 2023 survey by the National Student Clearinghouse found that over 40% of first-year business students struggle to identify their specific career track early on. The pressure to decide between the Certified Public Accountant (CPA) and Certified Management Accountant (CMA) is intense because the paths do lead to very different lives.

But here's the secret most textbooks won't tell you: it’s not about which certification is "better." It’s about which problem you enjoy solving. Do you want to be the Public Protector who ensures financial integrity (CPA), or the Corporate Strategist who drives future growth (CMA)?

In this guide, we're ditching the generic definitions. I'm going to walk you through the day-to-day reality, the salary trajectories (beyond just the starting bonus), and the honest difficulty of these exams so you can pick the path that actually fits you.

At a Glance: CPA vs CMA Decision Matrix

If you're short on time, this decision matrix cuts through the noise. Think of these as the "personality profiles" for each certification. While there is overlap, the core DNA of the work is distinct.

| Feature | CPA (Certified Public Accountant) | CMA (Certified Management Accountant) |

|---|---|---|

| Core Personality | The Auditor & Rule-Enforcer | The Strategist & Decision-Maker |

| Primary Focus | External Reporting, Tax, Compliance | Internal Management, FP&A, Strategy |

| Where You Work | Public Accounting Firms (Big 4), Private Practice | Corporations (Fortune 500), Manufacturing |

| Exam Structure | 4 Sections (16 Hours Total) | 2 Parts (8 Hours Total) |

| Avg. Time to Complete | 12–18 Months | 6–12 Months |

| Salary Boost | ~15-20% higher than non-CPA | ~63% higher total compensation (IMA 2023) |

Deep Dive: The Certified Public Accountant (CPA)

The CPA is often called the "gold standard" of the accounting world, and for good reason. It is the only license that grants you the legal authority to sign audit reports and represent clients in front of the IRS. If you imagine the stereotypical accountant—suits, tax season, and detailed audits—you're picturing a CPA.

What You Actually Do

CPAs are the guardians of financial trust. Your job is to look backward at financial data to ensure it's accurate, compliant with laws (like GAAP), and fairly presented. It involves a lot of scrutiny, rule-following, and checking boxes.

Historically, the CPA licensure began in New York in 1896, established to professionalize the industry amidst the industrial revolution. Today, it remains the gatekeeper for public trust in capital markets.

Who Should Choose This?

If you aim to work for a Big 4 firm (Deloitte, PwC, EY, KPMG) or start your own tax practice, the CPA is non-negotiable. It’s also the safest bet for maximum career flexibility early on, as it's easier to move from public accounting to corporate finance than vice-versa.

Deep Dive: The Certified Management Accountant (CMA)

While the CPA looks backward at what happened, the CMA looks forward to what should happen. The Institute of Management Accountants (IMA) governs this global credential, designed specifically for professionals working inside organizations to drive business performance.

What You Actually Do

CMAs are financial storytellers. You take the numbers produced by accountants and translate them into strategy. You'll answer questions like: "Should we launch this new product line?" or "Why are our manufacturing costs rising in Q3?" It’s less about compliance and more about value creation.

The "Hidden" Value

Here's a stat that shocks most of my students: According to the IMA's 2023 Global Salary Survey, CMAs in the U.S. earn a median total compensation that is significantly higher—up to 63% more—than their non-certified peers. This premium exists because CMAs are trained to directly impact the bottom line, making them indispensable in corporate leadership roles like FP&A Manager or CFO.

CPA vs CMA: The 5 Critical Differences

Most guides gloss over the nuances, but as someone who has mentored hundreds of students through both paths, I can tell you the differences are starker than they appear on paper. It comes down to five key areas: Curriculum, Difficulty, Cost, Salary, and the elusive "Career Ceiling."

1. Curriculum & Exam Difficulty

The Consensus: The CPA is a marathon; the CMA is a sprint up a mountain.

The CPA Exam covers a massive breadth of content. You need to know a little bit about everything—auditing standards, tax codes, business law, and financial reporting. It’s a four-part beast that demands around 300-400 hours of study time total. The pass rate hovers around 45-55% per section, but the challenge is retaining that volume of information over 18 months.

The CMA Exam goes deep. It’s only two parts, but don't let that fool you. The questions dive into complex strategic modeling and decision-making scenarios. You aren't just calculating a variance; you're explaining why it happened and what management should do about it. The pass rate is also around 45-50%.

2. Time & Cost Investment

Let’s talk numbers, because that’s what we do.

The CPA Breakdown:

- Time: 12-18 months typically. Check your state board, but you strictly have an 18-30 month window to pass all parts once you pass the first.

- Cost: Approx. $3,000 - $4,500 (Application fees, exam fees, and a review course).

- The Kicker: The 150-credit hour requirement effectively adds an extra year of college tuition for many.

The CMA Breakdown:

- Time: 6-12 months. It’s designed to be completed faster.

- Cost: Approx. $1,500 - $2,500 (IMA membership, entrance fee, exam fees, review course).

- The Kicker: You can take it while still an undergrad.

3. Salary Showdown & Career Trajectory

This is where the data gets interesting. Entry-level salaries are surprisingly similar, often landing in the $65,000 - $75,000 range for both paths depending on location. But the trajectories diverge significantly.

CPA Trajectory: Steady, predictable growth. You move from Associate to Senior usage to Manager. In public accounting, the path to Partner is clear but grueling.

CMA Trajectory: More variance but high spikes. CMAs often jump into leadership roles faster in the corporate world.

Real World Example: J'Maine Chubb, CFO of the Houston Airport System, credits his CMA certification as the key differentiator that allowed him to bridge the gap between accounting and strategic leadership, ultimately saving his organization millions through better royalty agreements. That’s the CMA value proposition: you aren't just counting beans; you're growing the farm.

The Verdict: Which Path fits YOUR Personality?

Ultimately, this isn't a test of intelligence; it's a test of fit.

Choose the CPA if:

- You thrive on structure, rules, and clear-cut answers.

- You want the most universally recognized credential that guarantees job security.

- You aim to work in public accounting (Big 4) or start your own tax firm.

Choose the CMA if:

- You enjoy solving complex business puzzles and "what-if" scenarios.

- You want to work inside a company (industry) and drive strategy.

- You want to fast-track your path to corporate leadership (Controller, CFO).

3 Common Mistakes Students Make When Choosing

After ten years of advising students, I see the same three mistakes destroy careers before they even start. Avoid these, and you’re already ahead of the curve.

1. The "Prestige" Trap

Is the CPA more famous? Yes. Does that mean it’s better for you? No. I’ve seen brilliant strategists suffer through 18 months of obscure tax law only to hate their audit job. Don't chase the acronym; chase the work you want to do.

2. Underestimating the Difficulty

Because the CMA has only two parts, students often treat it like a "light" version of the CPA. This is a fatal error. The questions are often longer and more complex, requiring deep analytical writing. Disrespecting the exam is the fastest way to fail it.

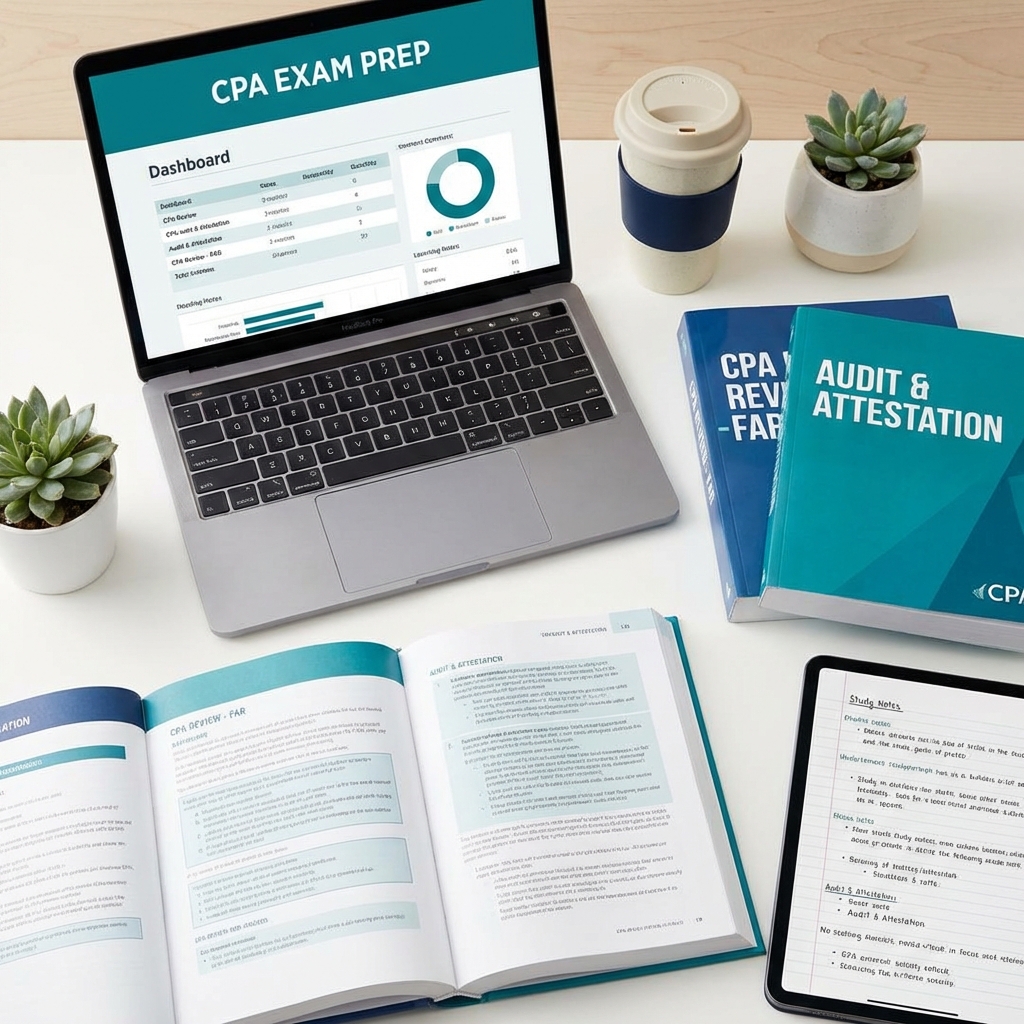

3. The "Lone Wolf" Error

Both exams are too hard to study for alone with just a textbook. Successful candidates almost always use a dedicated review course (like Becker, Gleim, or UWorld). Think of it as investing in your career insurance. Trying to save $1,000 now could cost you six months of re-taking exams later.

Essential Resources to Start Your Journey

Ready to dig deeper? Here are the official sources you need to bookmark immediately:

- Institute of Management Accountants (IMA): The global home of the CMA. Download their free handbook to see exactly what's on the exam.

- NASBA: Use this to check the specific CPA requirements for your state, as they vary wildly from Texas to New York.

- AICPA: The governing body for CPAs. Their "This Way to CPA" guide is excellent for students.

Conclusion

You started this article wondering which certification would give you a better career. Hopefully, you now realize that you define the career, and the certification is just the fuel.

The Bureau of Labor Statistics projects a continuing 4% growth in our field through 2032, but the real opportunities will go to those who specialize. Whether you choose the CPA's path of public trust or the CMA's path of corporate strategy, you are entering a profession that is recession-proof and rewarding.

Your Next Step: Don't just sit there. Tonight, go to the IMA or NASBA website and download the free exam syllabus for the one that sounded more "like you." Read the first page. If it excites you, you've found your path.